Uniting Citizens and Communities: The Transformative Power of Blockchain Bonds

Bringing municipal blockchain unlocks innovative opportunities for local governments and paves the way for global implementation

UETH’s very first Weekly Workshop explored:

The benefits and drawbacks of municipal bonds for communities and investors

Why Vice Mayor Ben Bartlett and the city of Berkeley are putting bonds on the blockchain

How the idea might translate worldwide to places like Princess Sarah Culberson’s native home of Sierra Leone

The predecessor to blockchain bonds for local funding

Municipal bonds, or “munis,” are a way city, county, and state governments raise money to fund public goods like sewers, bridges, affordable housing, schools, and hospitals. When these bonds are sold, bondholders collect interest and are eventually paid back, so they’re essentially local governments taking out a loan. To bondholders, they serve as financial investments.

Ruby Washington/The New York Times

Munis have been used for centuries, including by Italian city-states during the Renaissance. The first official record of one in the US was in 1812 for the City of New York to build a canal. Today, however, our cities need more — public funding and infrastructure are fading. Homelessness, for example, is getting worse across America, and more and more of the homeless population are senior citizens or families with children. As the earth gets hotter, more crowded, and unequal, we need shared goods and services to come back.

Why municipal bonds need an update

Two problems stand in the way between municipal bonds as we know them and adequate funding for the public goods our communities need. First, they aren’t accessible to ordinary people. They’re typically priced at $5,000 minimum and aren’t easily bought or sold. According to Bartlett, the muni resale market only has five big players on Wall Street, their operations are highly opaque, and it’s hard to find a tradeable chunk of munis for less than a quarter million dollars.

Minibonds, or microbonds, are solving the cost issue by reducing investment sizes to as little as $10 to $25. Smaller bonds have attracted strong citizen interest, but introduce a new problem. The additional cost of administering many more minibonds has been tough to manage for the cities like Denver that have issued them.

Bonds onchain and the possibilities they unlock

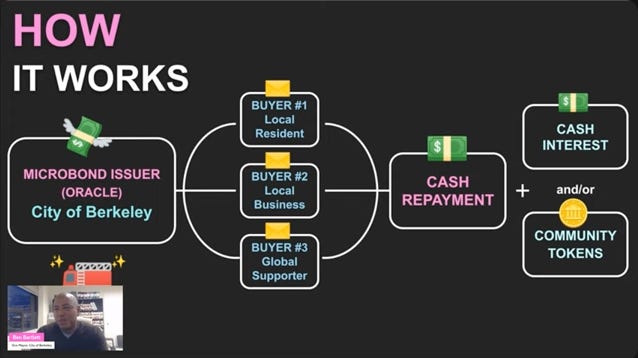

Ben believes that tokenizing bonds using blockchain technology is the answer to issuing minibonds at a lower cost. In 2019, he proposed a pilot program to raise $3 million to buy a new fire truck for Berkeley by issuing minibonds on the blockchain. In early 2024, it will finally go through. The bond sale will be made available first to local residents, then to local businesses, and then the world at large.

Since this is among the initial instances of a city issuing bonds on the blockchain, Ben aspires for the project's success to set a precedent for other local governments and upcoming initiatives. At scale, bonds issued on the blockchain should incur less operational costs than traditional methods. In addition to efficiency, blockchain bonds also mean greater speed and transparency. Then, there’s the possibilities surrounding bond interest payments taking the form of tokens. Instead of cash, these small token payments might be used to give back to the community in the form of things like coupons to local businesses, incentives for school children, or currency for homeless people, thereby further enhancing the well-being of local communities.

Win-win economics from Berkeley to Sierra Leone and beyond

Ben and his collaborators didn’t just have Berkeley in mind when coming up with this program. He hopes blockchain bonds can be used for public goods the world over in places like Sierra Leone, where the financial and physical infrastructure aren’t just weaker than in the US, but in some cases nonexistent.

When Sarah Culberson traveled to Sierra Leone to meet her birth family as an adult, she discovered that her family ran a chiefdom and that she was a princess. She’s since started a nonprofit called Sierra Leone Rising focused on public health, education, technology, and female empowerment in the country. Now, she’s leading the charge in getting NGOs like hers to understand what could be possible through blockchain bonds.

During the Workshop, Sarah and Ben discussed how organizations like hers, Engineers Without Borders, USAID, or DROP4DROP could use minibonds to crowdfund the development of artisanal community mines. Mines create jobs because they need everything from uniforms to security, landscaping, sales and marketing, and labor for the mines themselves. Mines also need water and energy, and the wells, water pumps, and solar panels set up for them could be used by the people who live nearby as well. This discussion sparked a collaboration between Ben and Sarah called the “Well Station” pilot project, which aims to leverage blockchain bonds to fund solar powered water pump stations - equipped with wifi, IoT metering, and digital payments functionality - to supply water to local businesses in Sierra Leone.

Both Sarah and Ben are especially excited about blockchain bonds — and the community projects they fund — because they’re win-win for holders and communities. During the Workshop, they agreed that the root of poverty isn’t lack of aid, but gaps in opportunities for wealth creation. Ben sees blockchain bonds as a chance for “the government to rebuild itself and generate wealth for people who are outside the system.” Technology’s purpose, he says, is “to help humans do things and to accomplish goals to make lives better.” We at UETH couldn’t agree more.

Get involved

Ben invites the UETH community to connect with him on LinkedIn

Berkeley students are invited to apply to intern at the District 3 Council Office

Follow Princess Sarah on Twitter. She responds to messages!

Watch the full Workshop + student Q&A here

Learn more about blockchain bonds: