Blockchain & Financial Inclusion: Empowering the Unbanked with CBDCs

How central bank digital currencies (CBDCs) are paving the way for greater financial access

In UETH’s third Weekly Workshop, our panel of experts weighed in on:

Current challenges faced by the global unbanked population and how CBDCs can enhance financial inclusion and stability.

Del Titus Bawuah, founder of Web3 Accra gave insight into the economic imbalance Ghana and its people face.

Kwame Oppong, Head of FinTech from Bank of Ghana discussed the cautious, deliberate and highly inclusive efforts to test the eCedi pilot project.

Dr. Jatali Bellanton, CEO of CryptoHedgeFund emphasized the importance of education in enhancing trust in emerging technologies.

Over 1.4 billion people globally face the reality of being unbanked

Imagine a place where average consumers can't securely save money, access credit, make digital payments, or shop online simply because they do not have access to basic banking services. Current banking systems are limited by:

limited geographical accessibility

high costs

stringent identification requirements

credit scoring limitations

low financial literacy

inadequate infrastructure

regulatory barriers

profit-driven motives

The Global Findex 2021 database reveals a concerning reality: 1.4 billion people globally are unbanked, a challenge most acute in rural regions. The lack of financial services in rural parts of Ghana and Africa is a glaring example of this global problem, underscoring the extent of financial exclusion among unbanked communities.

Del Titus Bawuah, founder of Web3 Accra, shed light on the challenges of bridging this gap. He emphasized that vast rural areas across Ghana and Africa harbor pockets of unbanked populations. Web3 Accra, acting as an intermediary between the Web3 community and policymakers, aims to propel Ghana - and the larger African diaspora - into a digitized future.

Bawuah's forward-thinking approach focuses on where the technology is heading, not where it is today. He commended Bank of Ghana for its proactive beta testing of eCedi, highlighting the potential economic value that blockchain and Web3 financial products can bring to the larger population.

Blockchain-based systems can help narrow the financial services gap

In a blockchain-based system, people can access financial services such as banking, lending, and remittances without relying on traditional brick and mortar banks or ATMs, which may be limited simply by geography. Digital currencies can reduce transaction costs and increase efficiency, potentially benefiting businesses and consumers in Ghana and Africa by eliminating intermediaries.

Small and micro-sized enterprises are a significant part of Ghana’s economy. The ability to transact in digital currency and provide verified, tokenized credentials of small and micro businesses give business owners the opportunity to participate in international trade. It allows for frictionless, borderless, and cost-efficient B2B and B2C transactions.

Central Bank Digital Currencies (CBDCs) are being leveraged by countries to empower financial inclusion

CBDCs are digital forms of a country's official currency issued and regulated by the central bank of that country. They are designed to be a digital counterpart to physical cash and can be used for everyday transactions, just like physical money or digital forms of money like bank deposits or credit cards.

Key characteristics of CBDCs include:

Efficiency: Transactions can be performed faster and with fewer (if any) intermediaries.

Financial inclusion: Online and offline capabilities provide services to those without reliable internet and mobile data access.

Reduced fraud: Advanced features of CBDC make them more resistant to counterfeiting and transactions are recorded on the blockchain providing transparency.

Centralized: Because it is the national currency it is managed by the issuing central bank.

While CBDCs offer various advantages to consumers, they also come with certain considerations. Namely, CBDCs do not have the decentralized structure of privately issued digital currencies such as Bitcoin. Therefore, it's essential for policymakers and central banks to responsibly plan and execute the introduction of CBDCs to weigh their benefits while addressing potential concerns.

Possible Future: The introduction of CBDC could reduce intermediaries and allow banks to focus on services.

Ghana’s eCedi offers a path to responsible inclusive innovation

In June 2021, eCedi was a proposed central bank digital currency for Ghana. The eCedi aims to digitize services for Ghana's 30 million people and complement the Ghanaian cedi as an alternative to physical cash. The eCedi has hosted wallets for online smartphone users, and also includes offline hardware wallet and smartcard options for areas lacking reliable internet or mobile data access.

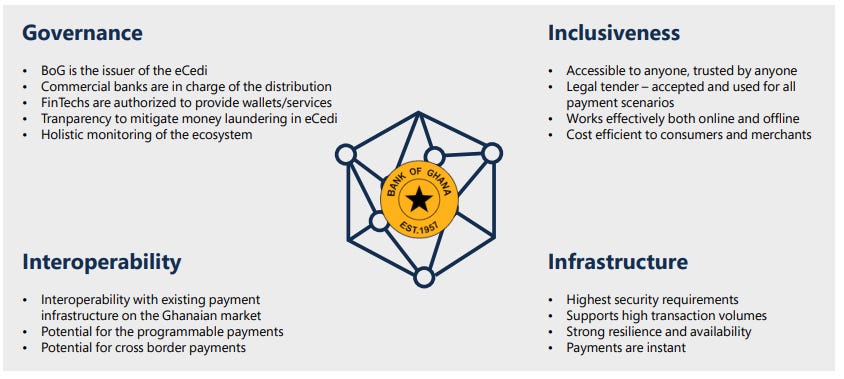

Results of the eCedi pilot program have been promising. Testing included reaching out to the furthermost remote “last mile” regions of the country to ensure the most rural citizens were not left behind. Designed with an acute awareness of the need for consumer protection and responsible innovation, the design of the eCedi follows these four design principles below:

Kwame Oppong, head of FinTech and Innovation at the Bank of Ghana, brings a rich tapestry of expertise in technology, finance, and regulatory frameworks. His journey from tech and finance into the realms of development and central banking positions him uniquely at a time when Ghana embarks on a digital transformation. As the Bank of Ghana and the government look to digitize the economy for more transparency, efficiency and broader shared prosperity for its people and industries, Oppong shared his larger vision for the future of Ghana.

Oppong is dedicated to establishing Ghana as a premier FinTech hub, showcasing blockchain technology as a model for other nations to follow. For that to happen, regulation clarity is needed. Working with partners like Web3 Accra has been instrumental in bringing the right partners to have conversations of what the framework can and should look like from a regulatory perspective.

Forging a Digital Future with Ease of Use

Dr. Jatali Bellanton, CEO of CryptoHedgeFund, emphasized that introducing emerging technology requires a tremendous amount of trust. That trust is built by education. Ghana is ripe for CBDC adoption as Ghanaians are accustomed to using mobile money and cards for payments. This trend surged globally during the pandemic and aligns with Bank of Ghana's vision of eCedi accessible to all citizens, with minimal barriers to entry.

Furthermore, the Bank of Ghana is designing the eCedi to make consumer usage easy and intuitive. Consumers should be able to make a payment with a minimum number of steps without a high degree of technical knowledge. While use of the eCedi use may be relatively smooth, educating consumers about their personal information is still very necessary.

Ghana’s Role in a Global Movement

The transformation of Ghana's financial landscape through CBDCs is not just a local endeavor—it's a global movement toward a more inclusive and digitally advanced future. The experiences shared by our experts illuminate a path forward. The pilot program is not a litmus test just for the Republic of Ghana but for the continent of Africa and nations around the world seeking to bring financial stability, accessibility and infrastructure for their citizens.

"I don't consider Web3 a success unless emerging economies can participate harmoniously," Del Titus Bawuah emphasized. "Web2 was initially consolidated by a few companies and then slowly disseminated to other parts of the world." As Ghana seeks to position itself as a FinTech hub and a model for others, the key lies in responsible innovation, clear regulations, and ease of use.

Get involved

Watch the full Workshop + student Q&A here.

Learn more about CBDCs:

Bank of Ghana: Design Paper of the Digital Cedi (eCedi)

Coin Desk: What is a CBDC?

Digital Asset: What is a Central Bank Digital Currency and why should people prefer CBDC over bank accounts

Connect with our experts on X:

Del Titus Bawuah @Web3accra

Kwame Oppong @KwameAviator

hello @Web3Accra, how do I reach out to you? I am unable to send a direct message on X and no email address. Thanks